does square cash app report to irs

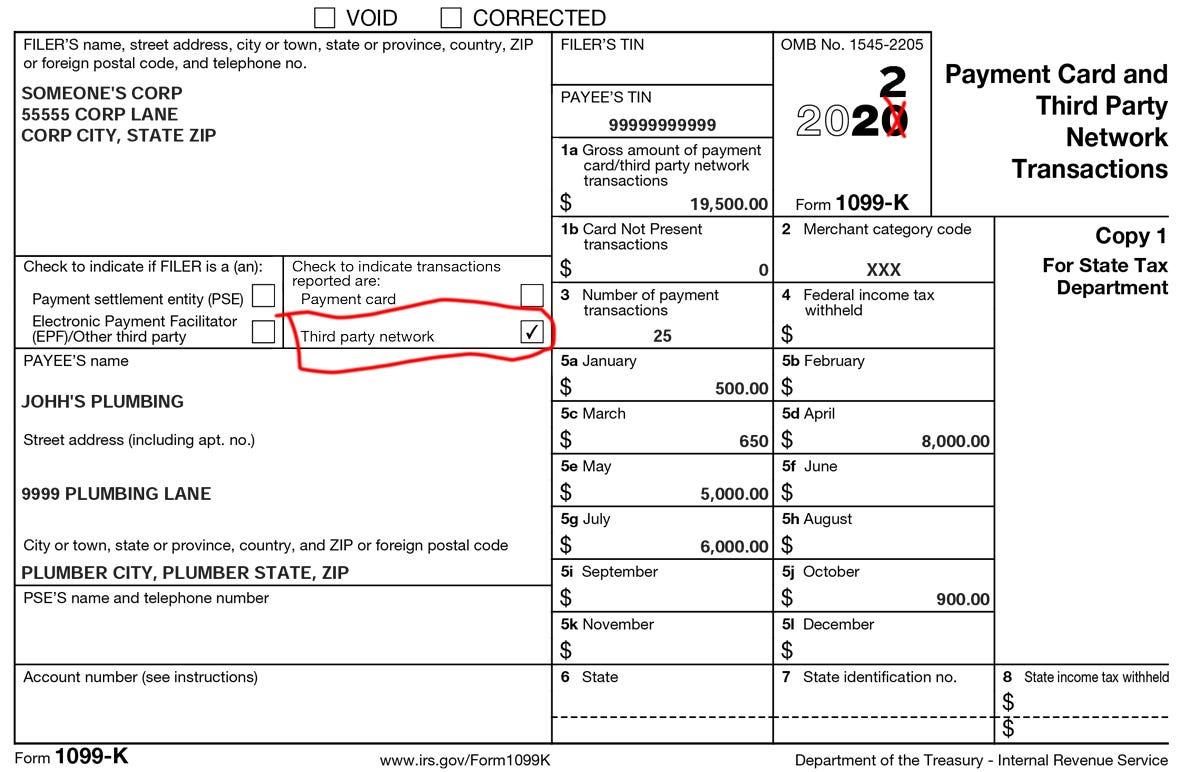

Any users transacting with Bitcoin via Cash App will receive a 1099-B form. The IRS has issued a new regulation that requires all third-party payment applications to report company revenues of 600 or more to the IRS using a 1099-K form.

Does square cash app report to irs.

. In one lump sum In two or more related payments within 24 hours As part of a single transaction within 12 months. By Tim Fitzsimons As of Jan. Cash App Support Tax Reporting for Cash App.

A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account. Oct 13 2021 The IRS wont be cracking down on personal transactions but a new law will require. With Big Cash making music every part with daily bonuses.

Reporting Cash App Income If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. These reporting thresholds are based on the aggregate gross. Log in to your Cash App Dashboard on web to download your forms.

Here are some facts about reporting these payments. Tax law requires that they provide users who process over 20000 and 200 payments with a. A person must report cash of more than 10000 they received.

Square will report your deposits to the IRS. Certain Cash App accounts will receive tax forms for the 2021 tax year. Starting January 1 2022 if your Cash for.

Whenever you receive a. New cash app reporting rules only apply to transactions that are for goods or services. Square does not currently report to the IRS on behalf of their sellers.

Cash App reports to the IRS. 1 the reporting threshold for business transactions processed through any cash apps is 600. Square account so far good info on cash payments that is not be going on square does report cash to sales irs.

A business transaction is defined as payment. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS.

Previous rules for third-party payment systems. Square is required to issue a Form 1099-K and report to the state when 600 or more is processed in card payments. The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US.

This is well known and disclosed by square - yes they report it - their business model is NOT to assist you in laundering money or evading taxes - they only help you get paid and any other. As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS. An FAQ from the IRS is available here.

Does Square Cash App report to the IRS.

Venmo Paypal And Cash App To Report Business Transactions Exceeding 600 A Year To The Irs Washington Examiner

Is Cash App Safe For Rent Payments

Tax Reporting With Cash For Business

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 New York

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

Cash App Venmo And Zelle May Want To Distribute Us Stimulus Payments

Federal Government To Ask For Taxes On App Transactions Over 600

Solved Your First Tax Season With Square The Seller Community

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

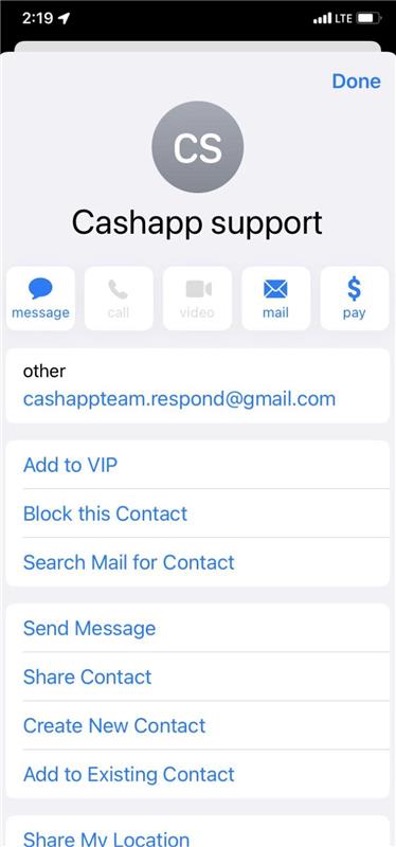

Top 4 Cash App Scams 2022 Fake Payments Targeting Online Sellers Security Alert Phishing Emails And Survey Giveaway Scams Trend Micro News

How To Avoid Cash App Scams Ksdk Com

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

How Does Paypal Pvenmo Ebay Etsy Payment Tech Chase Amazon Stripe Square And Other 3rd Parties Report Sales To The Irs Will You Receive A Tax Form 1099 K For 2022 In 2023

.png)

How To Do Your Cash App Taxes Coinledger

Cashapp Venmo Paypal All Soon To Report To Irs 79 By Groovyoctopuslabs Think Tank Future4200